|

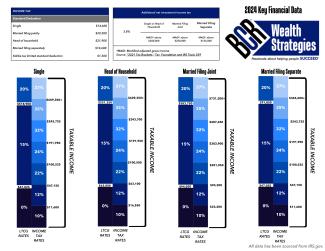

“2024 Key Financial Data”. To some, this probably sounds like it is going to be a boring summary of tax number updates. To us, it is a list of opportunities for us to help you with. Each year the IRS comes out with new limits, tax brackets, and opportunities for maximizing our ability to help you plan for the most efficient taxes. BCR then takes this information and creates a “cheat sheet” to help us reference these numbers as we create your financial plan. Below, I will list the items that we identified as key opportunities for many of our clients:

- Opportunities #1: New IRA and Roth IRA Contribution limits. In 2023, the maximum contribution to these accounts was $6,500 (+$1,000 catch up contribution for those over 50). In 2024, the new limit is $7,000. This is an additional $500 per individual that can go into retirement accounts. If you are in your 30s, that could mean thousands more dollars in your retirement accounts over your lifetime.

- BONUS: They also increased the salary range for Roth phaseouts, so if you previously were not eligible to contribute to a Roth IRA, that could have changed too.

- Opportunity #2: Annual Gift tax exclusion increase. For those anticipating large estates, it is often beneficial to gift as much as possible to their beneficiaries while they are still alive. There is a limit, though, to how much can be gifted to a single person without having to report it to the IRS as a gift. This amount was increased from $17,000 to $18,000 to 2024. This one is mutually beneficial to the gifters and the receivers.

- Opportunity #3: Standard Deduction. The standard deduction or all filing statuses has been increased. Meaning, the likelihood of needing to itemize to receive the maximum deduction is less than in years prior. This is probably a sigh of relief from filers and tax professionals.

Now for the boring stuff, the tax deadlines.

- 4th installment of prior year estimated taxes due – January 18

- Tax filing deadline- April 18

- Last day for prior year IRA and Roth contributions- April 18

- 2nd installment of estimated taxes due – June 15

- 3rd installment of estimated taxes dye – September 15

- Tax filing extension deadline- October 16

We are happy to send anyone a copy of our key financial data cheat sheet, please reach out to us if you would like one!

|