Are There Positives To A Down Market?

As we view the recent downturn in the stock market, we think about how relieving it would be to receive a steady 4% rate of return every year rather than having these ups and downs. However, a down market is not always a bad thing. There are several reasons why it is okay for the markets to occasionally correct. Here are a few:

- A reason that stocks can deliver a higher return than bonds is that stock depreciations scare people. Economists call it the “risk premium”, which means that investors aren’t willing to pay as much for an investment that will periodically frighten them as they would pay for an investment that delivers a relatively steady investment return. Over time, stocks have been a rather consistent bargain relative to less volatile alternatives, which is another way of saying that they can provide higher returns over time versus bonds and cash.

- If you’re accumulating by putting money in the market periodically, every downturn means that you can buy shares at a lower price while many other investors are selling out at or near the bottom. This is known as dollar cost averaging. Over time, as the market recovers, this can give a boost to your overall return.

- Market downturns give an advantage to those who are willing to practice disciplined rebalancing among different asset classes. This means that when a particular asset class (such as domestic stocks) goes down, other portfolio positions and any new cash is invested disproportionately higher into the down asset class to bring it back up to the former share of the overall portfolio. Rebalancing allows an investor to purchase more shares when the prices are low, and can also boost long-term returns.

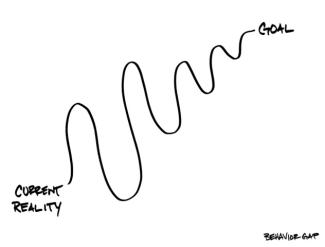

It’s difficult to maintain your composure when the equities market can be so volatile. Historically, markets do respond to corrections in a beneficial way, so we will likely look back on this decline and see a market-buying opportunity, rather than the right time to bail out of the markets. While it can be tough to stomach at times, volatility is actually the friend of a long-term, patient, disciplined investor.

-Justin Ladden-