Cash management during a crisis

An often-overlooked business planning activity is managing your current cash. During a crisis such as the COVID 19 pandemic and quarantine this becomes an essential factor for success. As Federal Reserve Chair Jerome Powell said recently, liquidity problems can turn into solvency problems. These recommendations are intended to empower you with information for making good decisions.

These are important steps to take to stay on top of your cash position. While these recommendations are written for small businesses they can be applied to personal cash as well.

Here are 3 rules of cash:

- Cash earlier than later

- More versus less

- Never zero

Cash earlier than later

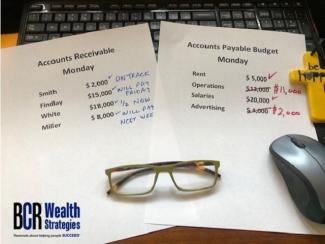

This means keep as much of your cash as prudently possible and collect as much of your receivables as possible. Many of your customers are experiencing the same cash constraints you are. Be the first to reach out to any customers who may not have current challenges and offer them better terms to pay earlier than normal. For your customers who call you to make payment arrangements, look at any alternative to no pay. It is less expensive to keep a customer than to get a new one, so evaluate the situation to see if this is a customer you want to keep. If they pay monthly, ask for some payment and roll forward the unpaid balance as is possible for your situation. If they pay annually, offer monthly or quarterly payments. In all cases, make sure you offer the customers the best service possible to keep you high on their list of service providers/suppliers they want to continue to do business with and therefore work to keep their payments current. It is important to maintain the relationship with your customers and they will remember your grace and kindness during this stressful situation. What you would normally review monthly, review weekly. Review your cash position every week during the crisis.

More versus less

Build your cash reserves. Review every resource you have – accounts receivable, accounts payable, inventory, bank relationships. Determine how each of these can help your cash balance. You may be able to leverage these assets with your bank for a line of credit. Determine if paying interest only on any accounts payable is in your best interest and agreeable with the payer. Ask for discounts on new purchases and ask for discounts for paying on and over time. Pay bills on time but never early.

Never zero

Over 80% of small businesses that eventually fail do so because they run out of money according to a 2019 SCORE survey. It is critical to stay on top of your cash position and cash forecast during a crisis. Have a weekly review of your current cash position and forecast what you will realistically receive and what you must pay out this week. Identify expenses that can be delayed or eliminated. Do the math and evaluate if your cash position has improved or deteriorated this week. The goal is to have a sufficient cash cushion for the next several weeks of expenses if no more revenue comes in. Work to maintain this position going forward. If your weekly cash position is trending downward, you need to evaluate longer-term activity will improve your situation. Do not get to zero!

These cash management principals are always important for any entity to survive during normal times but especially critical to manage during a crisis. Keep cash management in the forefront of your thoughts as you navigate these troubled waters.

Work closely with your banker, bookkeeper, accountant, financial advisor, and your local business associations. These advisors are more important than ever during financial challenges. And remember to maintain your professional and personal relationships for mutual benefit now and later.

-Sandra Cleveland-