Does My 401(K) Plan Have High Fees?

Let’s face it. Any service that you use or that is provided to you costs something. If the cost of bread goes up, we can notice this by the price tag on the bag. But what about your 401(k) plan? How do you know what the total fees are and if they are too high? Chances are you will not find the total cost you pay for your retirement plan account in one single place. The fees in your 401(k) plan vary depending on different plan bundling and features, but usually you are paying for recordkeeping, plan custodianship, third-party administering, fund management, investment advising and participant services. Take a look at the bulk of the fees broken out below:

- Administrative Fees – These fees are charged to keep the 401(k) plan running. These expenses cover the everyday costs of the plan including the recordkeeping, accounting and legal costs. Sometimes these costs are taken out of the plan’s entire assets, while other times a flat fee is charged from each person’s account.

- Investment Fees – These fees cover the management of the investments available in your plan and other investment-related services. In many cases, these fees cover the largest percent of your overall 401(k) fees. These expenses are assessed as a percentage of assets invested. (For a more advanced concept with funds and fund fees click here).

- Service Fees – There are usually service fees for special features and options. For example, there may be a service fee to set up a loan from your 401(k) account. These fees are usually applied to the specific participant who elects a special feature.

- Advisory Fees – If your company has hired an advisor to help service the plan, this could be an additional charge. This fee relates to participant education and fund monitoring/selection. Depending on the type of the advisor used, this fee could relate to liability protection to the company.

So how can you find out your plan’s total fees?

One way to start evaluating the fees associated with your plan is to look at the quarterly statement you receive. Even though this probably will not show all your fees, it most likely will show what you are paying for your investment elections. If for some reason you do not see this on your statement, ask your plan administrator in your office for a list of funds available and their expense ratios. Depending on the funds you select from your plan’s fund line-up, you may be paying a higher expense to actually be invested than the guy in the office next to yours. Different types of funds have different expense ratios. For example an international equity fund may have an expense ratio of 1.01% while a domestic fixed income fund may have an expense ratio of .45%. It may be wise to question funds that have an expense ratio greater than 1%. Make sure there is strong reason for supporting a fund with a higher fee.

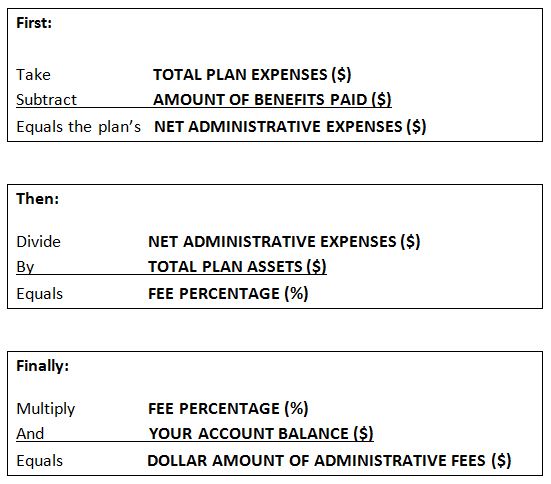

When it comes to administrative and other service fees, you should receive a fee disclosure, which the Department of Labor (DoL) now requires you to receive. If you accidentally tossed this in the trash along with undesired coupon offers, ask your Human Resources staff or plan administrator for this disclosure. An annual summary plan report would also be helpful. To calculate administrative fees, look in this document under in the section titled Basic Financial Statement. Next, follow the equation below:

It’s not so easy is it? No wonder few plan participants know exactly what they are charged each year.

What can you do?

Some fees are covered by your employer, but in most cases at least the majority of fees are passed to the participants, you.

If you are participating in your company’s retirement plan, talk the appropriate person at your company in charge of your administering the plan. Let them know that you would like to have a better idea of what you are paying with your retirement account. It may take more than just you to make a plan change or look into comparing costs, but consider collaborating with fellow employees as it may take a movement.

Employers who offer a 401(k) are encouraged by the Department of Labor to review the plan’s service providers every 3 years. A benchmarking report is a great way to see how the plan compares to plans of companies of similar size. This report identifies weaknesses and shortfalls, and can pinpoint what the employer and service providers can improve on. One of the categories in a comprehensive benchmarking is fees and expenses. This will breakdown the retirement plan’s fees and show how these fees stack up against a plethora of other companies. It is probably best to get a third party to run the report rather than the current plan provider. This way you can limit bias.

Don’t let this discourage you from investing in your company’s 401(k) plan. Contribute what you can and increase this percentage going forward. Be smart about how you invest your account, and please make sure you understand the plan and the expenses. Take advantage of employer contributions and think of it as a way to help cancel out fees. Like anything else you consume, fees are just the cost you pay for service. Realize that you do not want to pay more for any service you use, so a quick fee review is always advantageous.

-Justin Ladden-