Educating Our Children

High income members of Generations X and Y typically postpone starting families for various reasons (discussed in post "And So It Begins"). When we do start families, we are focused on providing them with everything they need in order to be happy and successful. This can cause a significant strain on finances. We are likely to feed our children expensive organic foods, pay for high-caliber preschools, and move to expensive neighborhoods in order to put our kids in the school system that we believe will provide the best education. We usually do all of this before considering how we will handle paying for college, weddings, and our own retirement. Those goals seem very far off, but they will be upon us much faster than we expect.

We stand on the shoulders of those who came before us. Many high-income members of Gen X/Y experienced privileged childhoods similar to the ones we seek to give our own children. We want to give our kids every advantage that we had as children. We want to contribute to their future success. What that means exactly is different for every family.

Take the costs of education, for example. For some high income Gen X/Y families, giving our children a great childhood means fully assuming the financial burden for their educations, thereby providing them the opportunity to focus on their education and leave school without debt. For others, it means teaching our children to appreciate their education by compelling them to hold jobs in order to pay their own way through school. However you personally define “the ideal childhood”, it is important for your children’s success and your success to discuss your plans and expectations as a family clearly and on a regular basis.

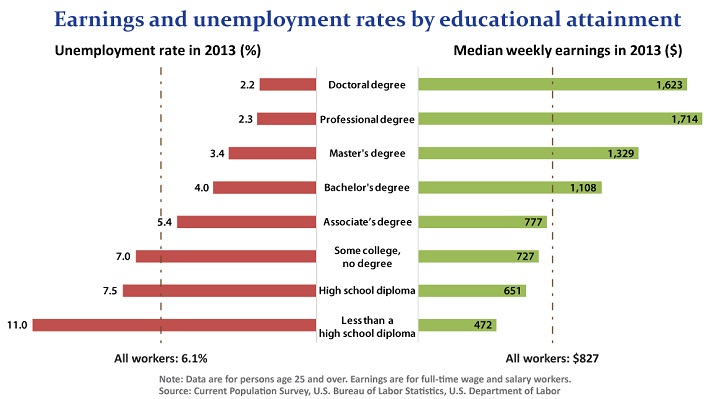

The cost of graduate and post-graduate degrees are outpacing inflation significantly and becoming a larger and larger burden on families and students. According to www.inflationdata.com, between December 31, 1985 and December 31, 2011 the Overall Consumer Price (CPI-U) went up 115.06 percent. Tuition went up 498.31% over the same time period. Even with those costs, higher education is becoming more valuable. Whether you measure by employment opportunities or earnings, future generations cannot afford not to get all of the education available to them. (See exhibit).

So how do we balance saving for and paying for our children’s education with our own retirement and other aspirations? The first thing to remember is you have many more opportunities to pay for education than you do to pay for retirement. You can pay for education before it is earned using savings (e.g., a 529 plan), as it is earned using your current income, or after it is earned through debt vehicles (e.g., student loans). Retirement, however, can only be paid for before it happens.

If we sacrifice our retirement savings to save for children’s education in advance, then we are putting our futures in their hands. Are they capable and willing to take care of us the way we want to be taken care of in retirement? Do we want to risk putting them in a position to financially support us if we outlive our assets? For most of us, the answer is no. If your answer is no, then you need to focus first on saving toward your retirement and putting excess towards prepaying for children’s education, not the other way around. This does not mean that you cannot assist or even helm the financing of your children’s education. We can continue paying off education debts during retirement. This is particularly true if you have saved well for your retirement and have plenty of money at your disposal during your retirement years.

When creating a financial plan, it is important to specify what you want to financially provide toward your children’s education. In my work, I often encounter spouses who agree that they want to provide for their children’s education, but don’t see eye-to-eye on how to accomplish this goal. Sit down with your spouse early and discuss these topics:

- Are your payments based on the cost of the school or are you going to provide a specified dollar amount regardless of the school your child chooses?

- Are you going to base your continued support on the grades and accomplishments s/he achieves while in school?

- What type of education do you want to provide? In-state public, out-of-state public, private school, and elite private school all come with very different price tags.

- What expenses are you prepared to cover? For example, are you willing to cover tuition only, or are you also willing to cover housing? Are you willing to cover off-campus housing? Are you willing to pay for your child’s social life, such as fraternity/sorority dues?

- How long will you pay for education? Will you continue to pay if your child needs more than 4 years to complete undergraduate school? Are you willing to cover the cost of post-graduate degrees? Who wins if they get scholarships? Do they get the extra money to start their lives, or will you subtract it from the costs you must cover?

- Do you feel that college expenses need to be equally provided to each child? If one costs less to educate than the others, will you make it up to him/her with additional gifts beyond school?

All of these questions are difficult and take time to discuss, but you will find that it is easier to plan the rest of your future and create expectations for your children if you come up with the details beyond “we plan to take care of education.”

-Marshall Rathmell-