Life Vs. Disability Insurance

When we meet for the first time with prospects or new clients, it is common that they have some questions they want to ask about understanding their life insurance, while they aren’t very curious at all about disability insurance. Many people have the option to obtain this type of coverage from their employer, but don't take advantage of it and don’t seem to be as concerned about it as they are about life insurance.

This may be understandable, but as medicine advances and life expectancies increase, so does the need for disability insurance. The new reality is that as important as life insurance is, for many of us, disability insurance will be far more important. Statistics show that those of us in Generation X and Generation Y have a much greater chance of being disabled before age 65 than dying before that age.

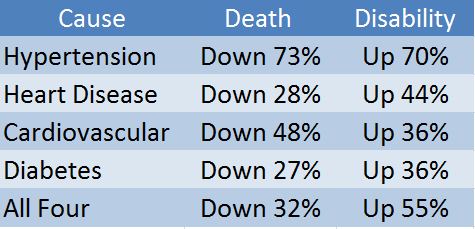

According to research from AffordableInsuranceProtection.com, men currently 55 years of age are one and a half times more likely to suffer a disability before age 65 than they are to die. For men who are 30, the likelihood of suffering disability is four times greater than the likelihood of death. This is because many of the medical conditions that used to kill us have begun to disable us more often over the last 20 years.

Why disability insurance is more important than life insurance

If you die before you expect to, your life insurance will replace the income you would have used to support your spouse and beneficiaries during your working career. But if you become disabled during your working years, your insurance benefits would have to provide for yourself in addition to your other beneficiaries. It would also have to cover unexpected costs that may occur because of your disability.

If you do not have disability insurance, we recommend obtaining this coverage as soon as possible. It is a vital component of a sound financial plan. Most employers offer it as an optional piece of their benefits package. In our next post, we’ll discuss how to evaluate your employer-provided disability coverage.