Medicare: Where Do I Start?

Medicare open enrollment is here – October 15th to December 7th – and from our experience and client feedback, it can be pretty intimidating. With the amount of sales advertisements that show up, the biggest question is where to begin.

Let’s start with what Medicare is. Medicare is the federal health insurance program for people 65 and over, certain younger people with disabilities, and people with End-Stage Renal Disease. While some people say that they look forward to the financial and career freedom that Medicare provides, I have yet to meet the person that is excited to qualify.

Next, we need to understand that there are different “Parts” to Medicare. Medicare Part A covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health coverage. Medicare Part B covers certain doctors’ services, outpatient care, medical supplies, and preventative services. Part A and B are also called the Original Medicare, A = Hospital, B = Medical.

Second, find out when you personally need to enroll. The first time you enroll is called your Initial Enrollment Period. Your enrollment period is seven months long, beginning three months before the month you turn 65, the month you turn 65 and ending three months after you turn 65. Some people may get Medicare automatically. If you are receiving Social Security benefits at least four months before you turn 65, you do not need to sign up.

Most people should enroll for Part A when eligible, but depending on if you are working or not and the size of your employer, you can delay Part B enrollment. If you delay and your employer has 20 or fewer employees, you may have to pay a Part B late enrollment penalty, and you may have a gap in coverage if you decide you want Part B later. You want to avoid any penalty, so know where your company stands.

Third, decide if you want Part A and Part B. It makes sense for a lot of individuals to enroll in Part A when they turn 65 because they don’t pay a monthly premium for coverage. When it comes to delaying Part B, it mostly depends on if you are working and your current coverage. If your employer has 20 or fewer employees, sign up for Part B. However, if they have 20 or more, you can delay one or both Part A and B. At that point it would be prudent to take a long look at the pros and cons of staying on your employer’s insurance or enrolling. Price and coverage are what really matters, so it may be worth talking to an insurance broker who specializes in this area.

Fourth, decide on your coverage. If you are enrolling and not delaying, you will want to look at all your coverage options and the costs associated. There is the Original Medicare (Part A and B), then there is Medicare Advantage (like an HMO or PPO offered through qualified private companies). Medicare Advantage is sometimes called Part C. You can also get additional coverage to cover your prescription drug coverage (Part D) or Medical Supplement Insurance (Medigap).

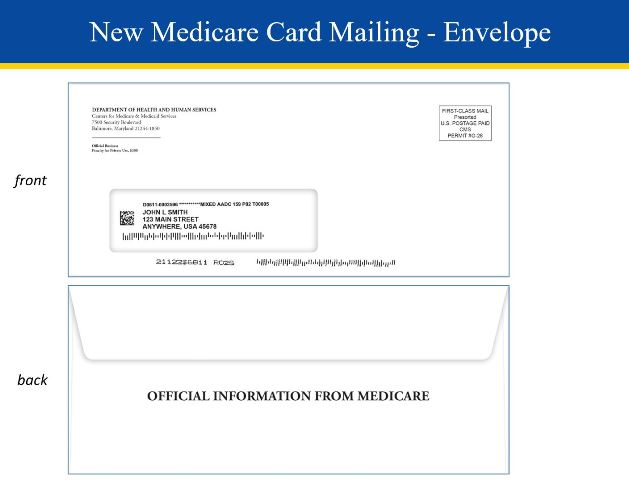

The last thing you’ll need to do is sign up. Unless you get it automatically, then you will get your Medicare card in the mail three months before you turn 65 – make sure and keep this card. Here is an example:

-Harold Sasnowitz & Clay Wood