Taxes Are Complicated

Taxes are complicated. That is why there are people whose entire job revolves around helping individuals pay the government what they owe. There are so many different variables that can affect the amount you are required to pay that it helps to have a professional assist you. To make it even more complicated, some folks who aren’t experts by any means spread misinformation, making it harder for non-professionals to understand.

I came across an article the other day that stated if you are on the lower end of a tax bracket, a 401(k) contribution could move you into the lower bracket. “If you make $80,000 per year, for example, and contribute $5,000, your resulting income of $75,000 would be taxed at 12% rather than 22%”...

The problem with this statement is that they are confusing the “Marginal” tax with “Nominal” tax. If you aren’t familiar with taxes, you may not be able to see why this is misleading, if not incorrect. I then went on to find multiple articles that explained the tax system this way. Using the same example, I’ll keep this super simple and show how tax brackets actually work.

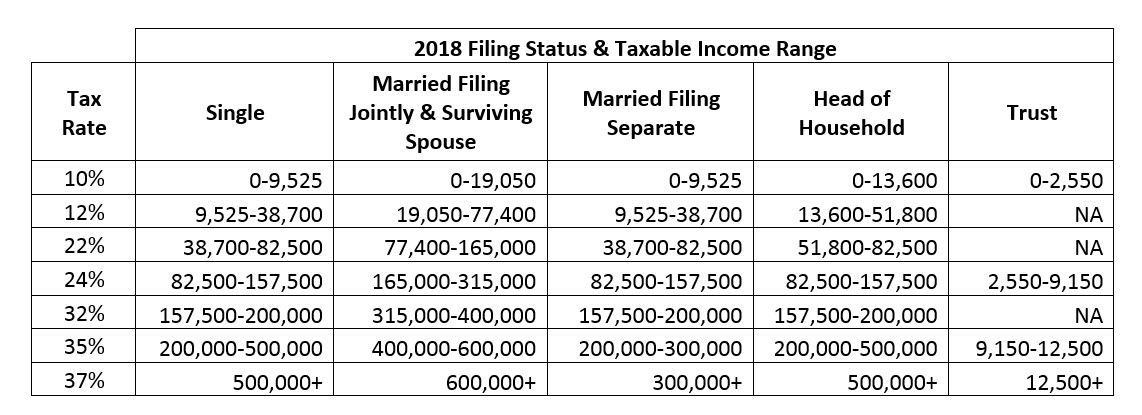

First, let’s talk about tax brackets. There are different brackets based on income and whether you are single, married filing jointly, married filing separately, or head of household. Here is the chart of the 2018 tax bracket chart.

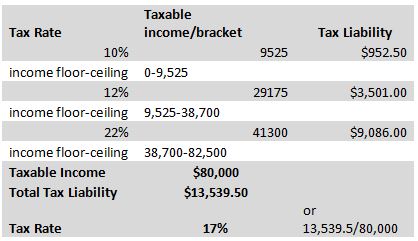

So, for our example, we will use a single individual, Jack, whose taxable income for the year is $80,000. This is $80,000 after all deductions and credits. It’s just a number to show how your income is used in the calculation with no other factors taken into consideration.

Here is what Jack will do to calculate his taxes. He will pay a 10% rate on the first $9,525 he made. Then, a 12% rate on the income above that, up to $38,700. Then, a 22% rate on the income above that, up to $82,500. In this case, he only had a taxable income of $80,000, so we stop there.

The article incorrectly stated that because Jack’s marginal rate, or the bracket his taxable income falls into, is 22% that he would be on the hook to pay taxes on 22% of all of his taxable income when in fact Jack’s actual or “nominal” tax rate would be about 17%.

If someone tells you to make sure you defer some money or send it to charity to make sure you don’t pay extra in taxes on all your income, just remember that’s not really how it works.

-Clay Wood-