What to be Scared Of in the Financial Markets – Part 2 of 3

Most people we talk to have been mentally affected by the fairly recent (in financial terms) 2000 Dot-Com crash and the 2008 recession. At this time in history, people are more fearful than ever about being in the market when it is going down. When we look at our clients, we are more scared of them not being in when the market is going up because we weren't put here on earth to be investors. We are here to be survivors, and survival instinct goes against investing common sense.

(Click to read Part 1.)

Part 2 – Missing Out on the Best Days

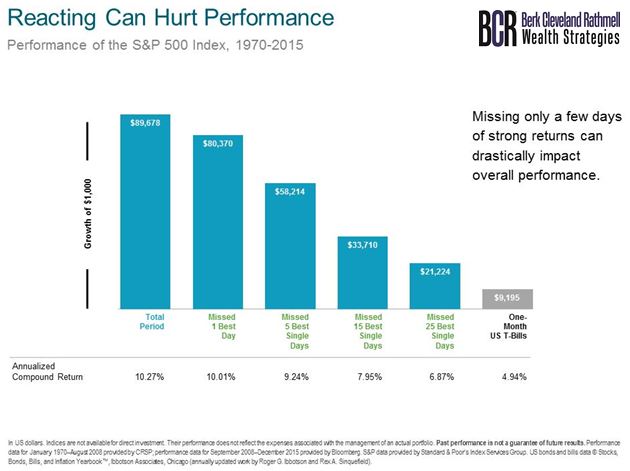

Responding to a crisis in the markets by bailing out can hurt your performance in the long run. To illustrate this point, let's start by looking at how the S&P 500 performed between 1970-2015.

The chart above shows that over this 46-year period, the S&P 500 had an annualized compounded return of 10.27%.

If you were out of the market on the single best day between 1970 - 2015, the S&P 500 return dropped to 10.01%. That means missing out on only one day decreased your compounded earnings by over a quarter percent each year.

And the longer you stayed out, the worse your portfolio performed. Missing out on the five best days resulted in a 7.95% return, and missing the 25 best days dropped your earnings to 6.87%.

Trying to miss the worst days seems logical and preys on our instinct. You are going to constantly hear projections on the news about the doom that will be happening. Next time try to remember that when it doesn’t you could be losing out on far more than you prevent when it does.