Tax Smart Investing Part 1

Investors across the globe put their money into the markets wanting a positive experience. The decisions they make impact

Moving into a new home can be a big leap in many people’s lives, but even more so for young adults. Whether it be graduating college, getting married

The Importance of Keeping an Eye on your Net Worth

There are so many financial metrics people use to measure their financial progress. One metric that is

Just like you know what kind of car you own and what fits in it (most of the time), you want to know what securities you have invested your money in.

As

Let’s imagine for a moment that on your daily walk to work, your normal route takes you past a pawn shop that is known to display expensive jewelry. Over the

It shouldn’t be a surprise to anyone that interest rates are at historical lows. So, paying off certain types of low interest debt, is like throwing away

Are you someone who sits down at the beginning of the year and plans out how much you will be investing into your retirement? If you are, now is a good

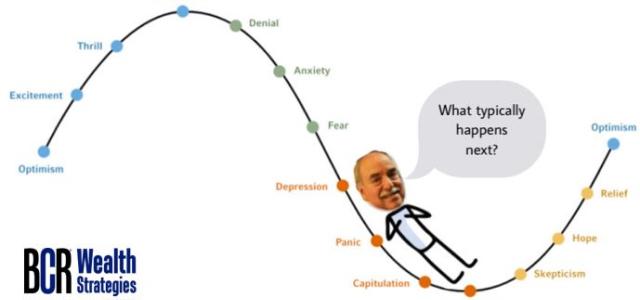

When financial advisors get together at conference and study groups many of the client stories are similar. They go something like this: the market shows

Thinking about moving in with your significant other? This is a big life event that should prompt some money conversations. How you will each contribute? What

We could never have imagined being in a pandemic for another WHOLE year. But if this year has taught us one thing, it is to stay focused on the long term and

Consider money you’re putting away for a long term (think twenty years away – say for retirement or a young child’s college expenses) expense. Often people