During these difficult times we and some of our peers have had people ask us:

“I am not confident that we have seen the bottom. What would be the harm in making a small tweak to my portfolio to reduce the risk? Instead of rebalancing and buying what has gotten low, shouldn’t we change my asset allocation by 10%? What would be the impact if I am wrong and we are at the bottom?”

Professional advisors like BCR® Wealth are trained to take advantage of the buying opportunities that occur in times like this. I started to wonder: could we quantify how a “small tweak” can harm you? I reached out to our friends at Dimensional Fund Advisors (DFA) to run some scenarios for us. If you want to understand the specific data I am looking at, benchmarks used, legal disclosures, etc., then check out THIS PDF. For everyone else, DFA created and tracked hypothetical portfolios using benchmarks that would show what would have happened in the scenarios I requested. Without further ado, here are your two scenarios:

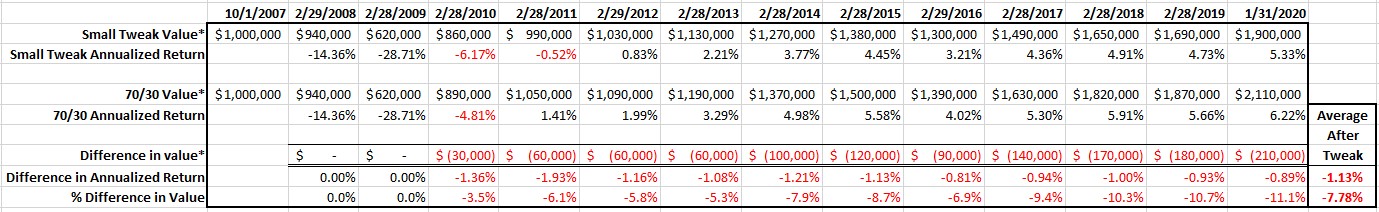

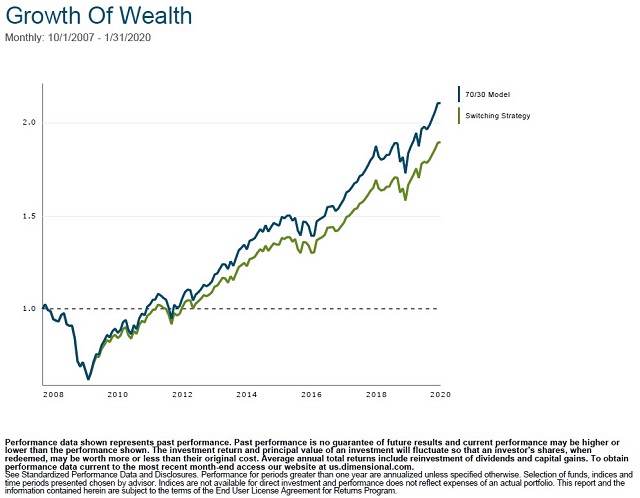

Two $1,000,000 portfolios created 10/1/2007 are invested identically: 70% into global equities and 30% into global fixed income. They stay the same and are rebalanced quarterly through the financial crisis downturn. On 2/28/2009, both portfolios have $620,000* remaining. Remember, at that time, the media and general public believed we were going to fall much farther.

This is when we make our “small tweak”, adjusting one of the portfolios to 60/40 trying to stop additional losses. Unluckily for the small tweak scenario, the market bottomed in March of 2009.

We ran the scenarios to look at the differences at the end of February every subsequent year and ended January 31, 2020 to see where they were right before the market started going down due to COVID-19.

Here is what stands out to me from these scenarios:

- The difference in value is greater than the annualized return all eleven years and after January of 2020 (11.1% difference in value) is almost twice the annualized return (6.22% for the 70/30 portfolio). In other words, the damage done is somewhere between a year and two years of growth.

- 24 months after the bottom the 70/30 portfolio is above the original $1,000,000 invested while the “small tweak” is still in the red.

- The percentage difference peaks at that 24-month mark with a 1.93% difference in the annualized return. I would suggest after that it is just the difference in having a 60/40 or 70/30.

- Even though it took the damage from the financial crisis the 70/30 portfolio more than doubled before COVID-19 started damaging the market while the “small tweak” scenario never doubled.

As I write this, it is Saturday, March 28, 2020 and this past week we saw the largest weekly increase in the Dow Jones Industrial Average since 1938. I believe we have a long road to go with this health crisis and we could go lower once again. No matter where it goes, my hope is that none of our readers did a “small tweak” this past Monday.

So where do we go from here? I know professional advisors sound like a broken record: “Stay the course!” “Rebalance!” “Don’t change your allocation based on the market!” …but it is for good reason. Academic research tells us that the majority of people who make changes during fearful times harm themselves while a small few will claim to have timed it to create a gain.

If you are Marty McFly or Doc Brown do me a favor and bring me back the data from the future. If you are not, I will continue to tell you that at BCR we are more worried about your financial plan being derailed by missing out on the good days than weathering through the bad ones.

-Marshall Rathmell-

*Based on Returns Web (the program used to analyze the data) all values are rounded to the nearest $10,000.