What you need to know about the recent sell off

Our investment philosophy, Evidence Based Investing, teaches us to invest using the academics not the emotions in the market because unfortunately emotions in investing usually cause you to make a big mistake.

While we can demonstrate to our clients why we are more concerned about them missing out on good days in the market than living through the bad ones it doesn’t prevent emotions from causing them concerns. This appears to be one of those times as we have had clients reach out (even before last week) to ask if we think they should have us change their portfolios since the market has done so well the past year. The theory being we must have even more losses coming than we saw last week and yesterday.

To directly address clients and non-clients who may be thinking this but not asking the question let’s talk about what has happened the last several days and some of the historical evidence around last year’s growth.

Last week we learned that:

· The American economy just added 200,000 more jobs—more than expectations

· The U.S. jobless rate now stands at 4.1%, the lowest since 2000

· The average hourly earnings of American workers have risen more than expected, 2.9% over a year earlier, the most since June of 2009

Chances are, you don’t find this alarming (and to be cleared I don’t either) but then again, you don’t work on Wall Street. After hearing these benign government statistics, traders rushed for the exits from the opening bell to the closing, and the S&P 500 stocks were left, in aggregate, worth 2.13% less than they were the day prior.

To understand why, you need to follow some tortuous prognosticator’s logic. According to the alarmist view, those extra 200,000 jobs might have pushed America one step closer to “maximum employment”—the very hard-to-define point where companies have trouble filling job openings, and therefore have to start offering higher wages. No, that’s not a terrible thing for most of us, but the idea is that if companies have to start paying more, then they’ll be able to put less in their pockets—and the rise in the hourly earnings of American workers totally confirmed the theory.

If you’re an alarmist, it gets worse. If American workers are getting paid more, then companies will start charging more for whatever they produce or do, which might raise the inflation rate. “Might” is the operative word here. There hasn’t been any sign of higher inflation, which is still not as high as the Federal Reserve Board wants it to be. But if you’re a Wall Street trader who thinks the market is in a bubble phase, you aren’t necessarily looking at facts to confirm your beliefs.

Suppose you’re not an alarmist. Then you might notice that 18 states began the new year with higher minimum wages, which might have nudged up that hourly earnings figure that looked so alarming a second ago. And some companies have recently announced bonuses following the huge reduction in U.S. corporate tax rates, whose amortized amounts are also finding their way into wage statistics.

Meanwhile, those same government statistics are showing a resurgence in factory activity and a rebound in housing, which account together for more than 50,000 of those new jobs.

You don’t have to ask yourself if the alarmists are right. I personally see some of their concerns being accurate in our attempts to hire. The more important thing to acknowledge is we live in a world too complicated to make accurate judgement calls on predicted outcomes from causes that may or may not pan out. So the question we all have to ask ourselves is: are we alarmists?

Selling in anticipation of a bear market has never been a great strategy, even though stocks are admittedly still priced higher than they have been historically.

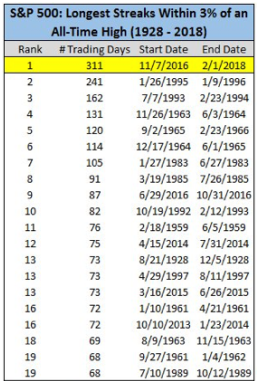

If you are not an alarmist, then look at the history of what happened over the past year and you have something to celebrate. The S&P 500 has now officially ended its longest streak without a 3% drop in its history:

It’s a historic run not likely to be seen by any of us again. The truth about the markets is that short, sharp pullbacks are inevitable and routine—unless you were living in the past year and a half, when we seemed to be immune from normal market behavior.

-Marshall Rathmell

Some of the material above was prepared by Bob Veres Inside Information.