Strategies for Success: Advisor Value

As a follow-up from our recent Tax Smart Investing presentation, we are posting several blogs that explain some of the concepts that we discussed. Some of the benefits of tax smart investing are included in several studies analyzing the value that working with a financial planner can add. Today we will discuss those studies.

Other Tax Smart blog posts that were developed from our presentation that you may be interested in reading are:

- Strategies for Success: Roth Contributions & Conversions

- Strategies for Success: How to enhance your tax savings from charitable giving with a Donor-Advised Fund (DAF)

- Strategies for Success: How Asset Location is Tax Smart

- Strategies for Success: Tax Loss Harvesting

Before we jump into the studies and data, I would like to point out that these studies do not pertain to everyone’s situation and may vary depending on the type of advisor you work with, and the services offered.

Some of the firms that have completed similar studies include Vanguard, Envestnet, and Morningstar. The goal of these studies is to show the value advisors can add through relationship-oriented services, rather than trying to outperform the market. In retrospect, you would expect that the value added would offset the fee charged by the advisor.

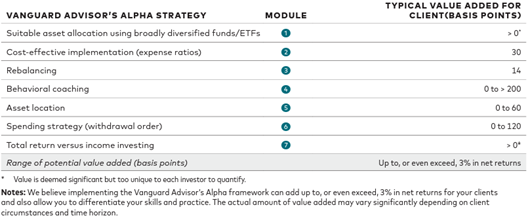

Let’s take a look at the most popular study of the three, Vanguard’s Advisor’s Alpha. Vanguard has done research to best estimate the value that an advisor can add through certain planning opportunities such as charitable-giving strategies, estate planning, tax-loss harvesting, and several other areas. Some of the topics covered in our recent presentation are included in this study, such as asset allocation and asset location. While it can be hard to measure this value, Vanguard estimates that advisors can add up to, or even exceed 3% in net returns:

Understanding what your advisor does for you can help better realize the value that they are adding. Asking certain questions can make sure you are receiving the value you are being charged for. Does your advisor think through the types of accounts you need? Which accounts to contribute or withdrawal from? The types of asset classes that should be placed in each account? Asking these questions can ensure you are working with the right person.