Strategies for Success: Roth Contributions & Conversions

As a follow-up from to our recent Tax Smart Investing presentation, we are posting several blogs that explain some of the concepts that we discussed. The presentation was specifically focused on ways to improve your portfolio’s lifetime after-tax return.

Our presentation provided some high-level analysis of tax-advantaged investment account types including a comparison of Roth vs Traditional accounts. This blog will go into more detail on when and how to take advantage of the benefits of Roth accounts.

Other Tax Smart blog posts that were developed from our presentation that you may be interested in reading are:

- Strategies for Success: How to enhance your tax savings from charitable giving with a Donor-Advised Fund (DAF)

- Strategies for Success: How Asset Location is Tax Smart

- Strategies for Success: Tax Loss Harvesting

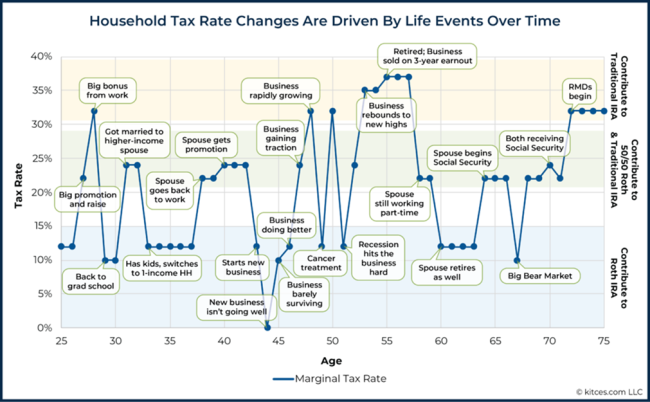

The chart below is one of my favorite slides from our presentation. It shows how an individual's tax rate changes over the course of their life.

We see this all the time with our clients as they change jobs, get big promotions, decide to sell their business, or decide to retire. As you can see on the slide, the different shaded areas indicate that when your life events cause your tax rate to drop below what you think it will be in the future it makes sense to put retirement savings into Roth accounts.

When you get a big bonus, promotion, or other income-increasing life event, and your tax rate goes up it would make more sense to switch back to traditional retirement account investments, so you get to deduct your contribution and reduce the amount of income subject to the higher tax rate.

If your income falls somewhere in the middle of what you think your lifetime tax rate range will be, we think it makes sense to take advantage of contributing to both Roth and Traditional accounts. This allows for tax-efficient asset location strategies (Strategies for Success: How Asset Location is Tax Smart), another concept that we covered in our presentation, that allows us to match different investment types with different account types to maximize their tax efficiency.

The question we often get is, when I am in one of the low tax rate scenarios, how do I get money into a Roth account? Don’t I have to have earned income? What if I make too much income, and I am above the income phase-out limit? Isn’t the maximum Roth contribution a very small amount ($6,500 in 2023)?

Fortunately, the tax code allows for many solutions to these questions.

A normal Roth IRA contribution has a couple of requirements: 1) you must have earned income greater than or equal to the amount you want to contribute 2) you must be below the income limit for the year ($153k single / $228k MFJ in 2023), and 3) you cannot contribute more than the annual contribution limit across all of your IRA’s (Traditional and Roth).

A “Backdoor Roth Contribution” allows you to circumvent the income limit, by making a non-deductible contribution to a Traditional IRA, and then converting those funds to a Roth IRA, because you did not take a tax deduction for the contribution, there is no tax impact on the conversion. There are some additional nuances to this strategy (especially if you have other IRAs) and it must be reported correctly on your tax return, so we recommend coordinating with your financial advisor and tax professional if you are looking to implement this strategy.

Roth 401(k)’s are much simpler and can allow you to avoid both the income limit and the low IRA contribution limit. We often see these as an option offered by our clients' employers. Making a Roth 401(k) contribution is as simple as letting your employer know you would like to switch your 401(k) contribution from Traditional to Roth. This raises the contribution limit up to the max 401(k) employee contribution limit ($22,500 in 2023). If your employer offers a match this will still be contributed as a pre-tax traditional contribution - the pre-tax employer match is scheduled to change in 2024 and beyond for high-income earners (SECURE Act 2.0: The Top 3 Changes You Need To Know)

Roth Conversions are potentially the most powerful option when you experience a low tax rate year. These allow you to take your large pre-tax traditional IRA amounts and convert them to a Roth account - without any contribution maximums (because the money is already in an IRA), and without any income limits. Unlike in the “Backdoor Contribution” these conversions are taxable, and we strongly recommend working with someone who can help you model what your taxable income will be for the year, to help you determine how much to convert in the current tax year. The general idea would be to convert enough to fill up any tax brackets you are in that you think will be lower than your future tax brackets.

Predicting your future tax bracket is the hard part, but we commonly see our clients end up in higher tax brackets than they expect in retirement due to investment growth, and high required minimum distribution (RMD) amounts. Recent changes from SECURE act 2.0 (SECURE Act 2.0: The Top 3 Changes You Need To Know) thankfully push RMD back to age 73 for now and to age 75 in the future, but the downside to that is now you must squeeze more distributions into a smaller window leading to higher tax rates.

In addition, if your IRA is then inherited by your children, they will have to fully withdraw all the money from the account within 10 years at their ordinary income tax rates, likely during their highest earning years.

One final point that has been on our minds a lot lately is the scheduled tax law change at the end of 2025. This scheduled change reverses many of the tax cuts from 2017 and reverts back to the higher tax brackets from pre-2018 tax law.

Roth accounts can help you avoid all these issues, and a Roth conversion allows you to control the timing, and to an extent, the tax rate that gets paid on your invested money.

A critic of Roth conversions might point out that it will increase how much tax you pay in the current year, but if you take a step back and look at the bigger picture you will see that, if done correctly, it has the potential to greatly reduce your lifetime tax rate.